Historic Invoice Finance Market Research Reports

This page provides access to our archive of historic invoice finance market research reports. Here you will find past surveys, studies and articles covering topics such as funding levels, costs, late payments and industry developments. While these reports are no longer the most recent, they remain useful for identifying long-term trends and for reference alongside our latest market research.

Historic Articles

- The Invoice Finance Companies recruiters plan to use.

- Comparing trends in invoice finance versus business loans - this video looks at the differences in online search traffic for the different product types. It compares various forms of receivables financing with business loans.

- 1 in 5 £1M+ turnover companies are using receivables finance.

- Invoice finance company online searches for customer reviews.

- Are revolving lines of credit more popular than single invoice financing?

- Which invoice finance companies are rated most highly by their customers?

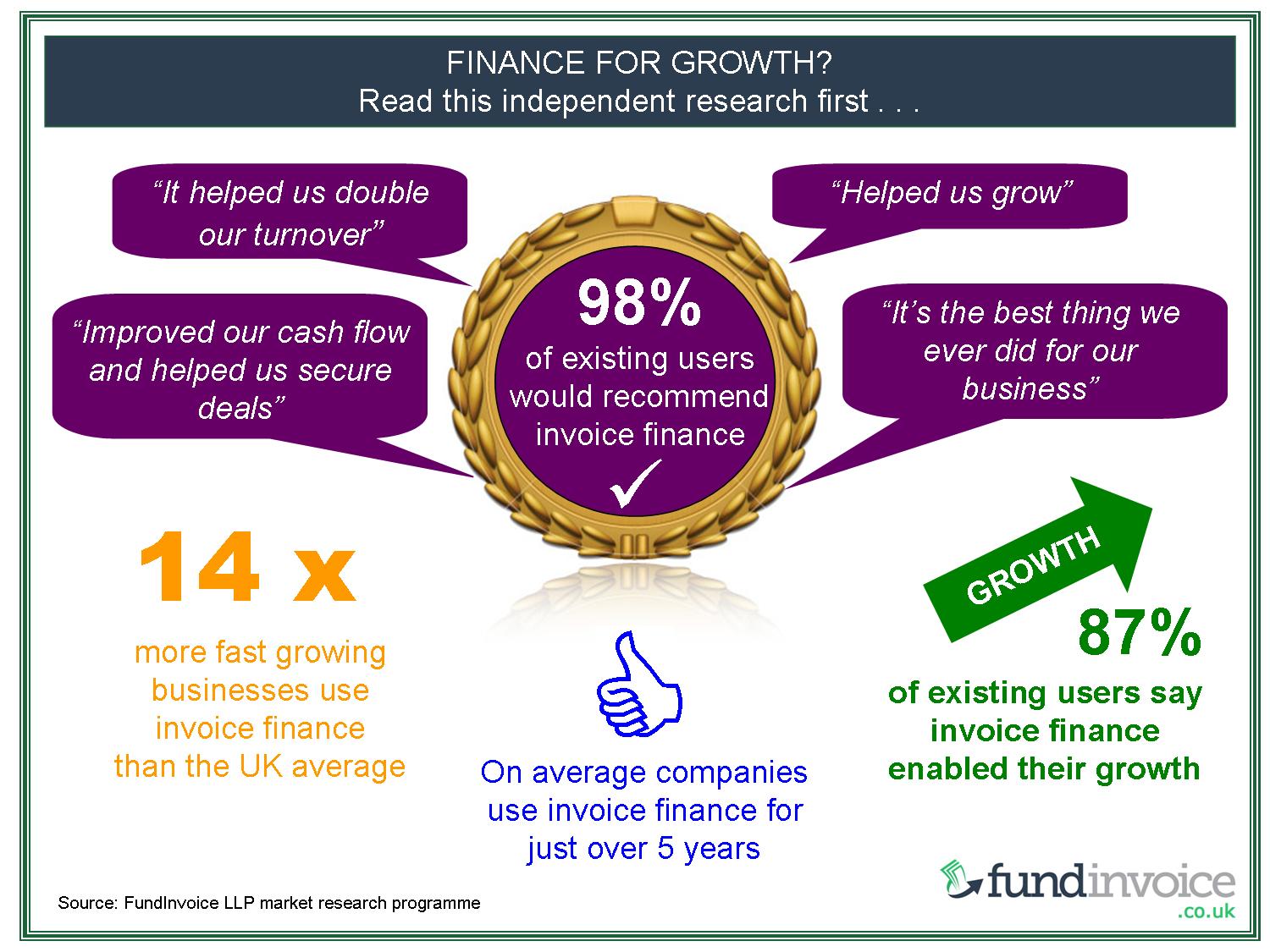

- The percentage that recommends invoice finance to fast-growing companies.

- Sizing the UK invoice finance market

- Average cost savings we have found clients

- Confirmed - the link between using invoice finance and fast growth

- Levels of awareness of different products (e.g. factoring, invoice discounting & construction finance) and providers.

- What are the barriers and pitfalls to businesses taking up invoice finance?

- What would clients like to see improved or offered?

- How clients would like products to be structured.

- How fast-growing companies and new startups fund their businesses.

Infographics

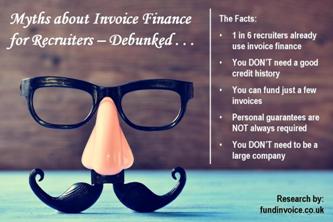

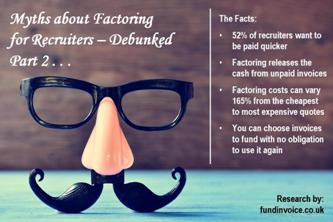

Adverts for the #IFaware campaign:

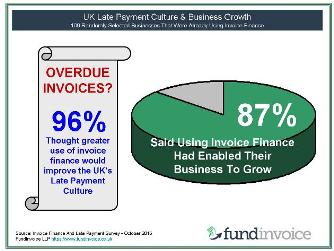

UK late payment, growth and recommendations for invoice finance:

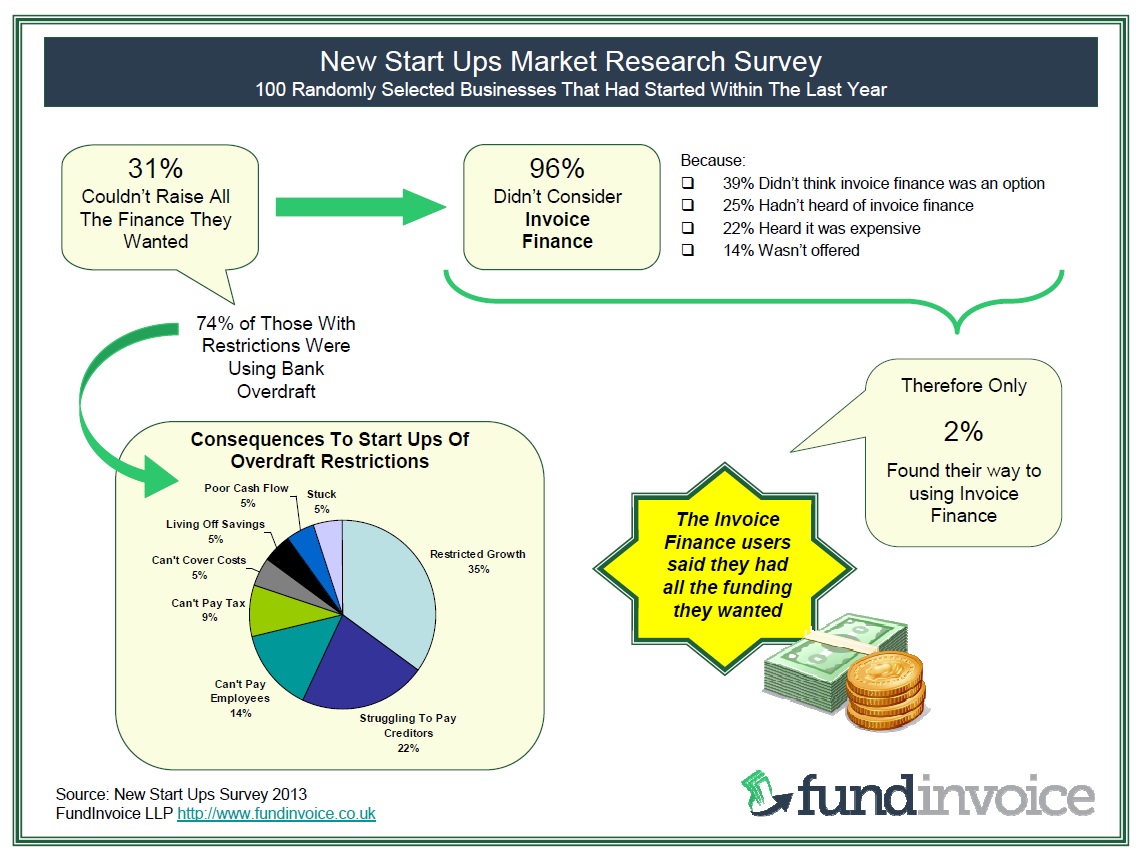

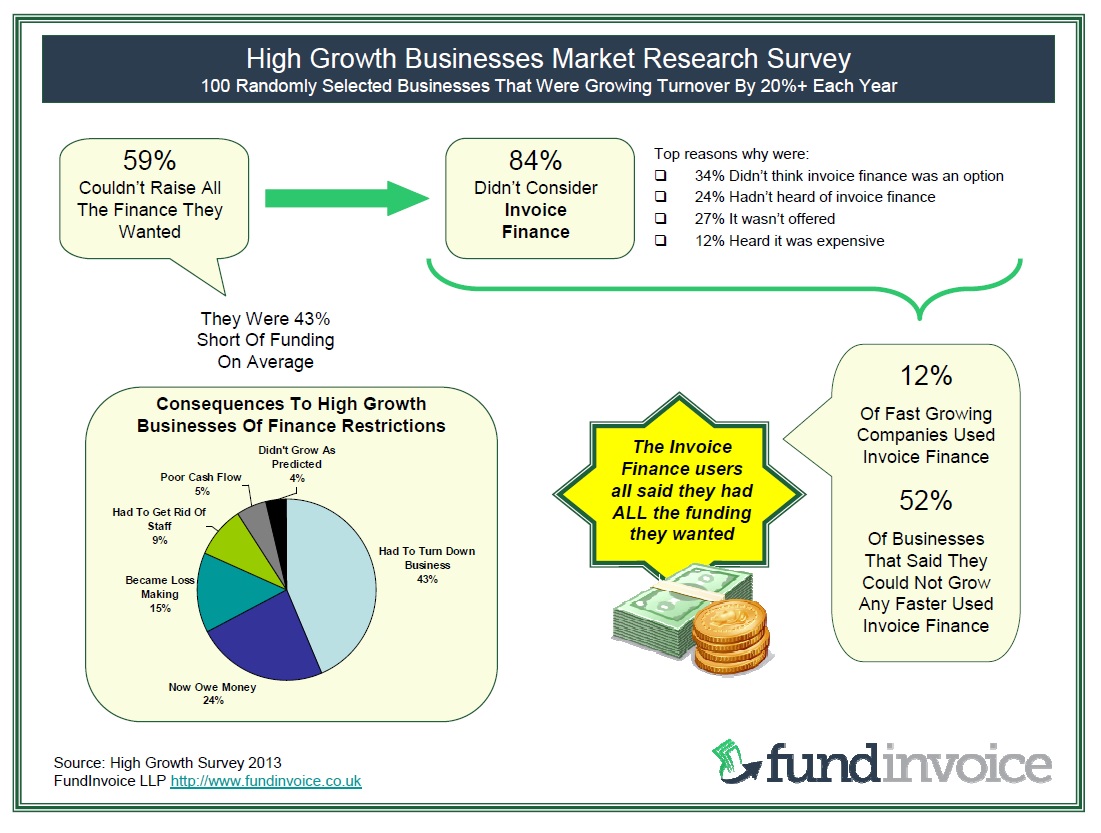

New startups and high-growth funding:

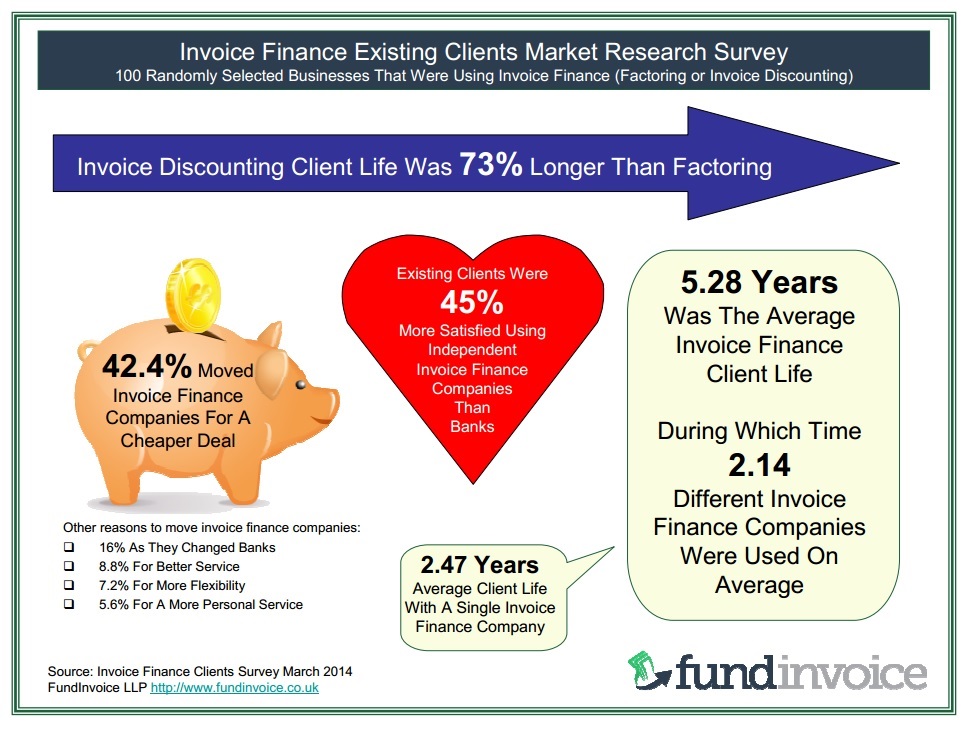

Market sizing and existing client research:

Infographics in PDF format:

- What Invoice Finance Users Think

- Invoice Finance UK Market Sizing 2014

- Invoice Finance Clients Survey Review Findings

- Financing New Start-Ups Market Research Findings

- Financing High-Growth & Fast-Growing Businesses Market Research Findings

Historic Research Summaries

These are links to the various older research summaries that pull together our findings:

- Business Finance Research Summary May 2016 - This simple list of bullet points summarises the key findings to date from our business finance research programme.

- Invoice Finance Research Report July 2015 - a summary of the research findings from January 2015 to July 2015. Including percentages that will recommend invoice finance, eligibility, why customers pick invoice finance, advertising methods being used, price checking, how to increase user numbers, switching invoice finance companies, and overdraft versus alternative finance.

- Invoice Finance Research Report January 2015 - a summary of the research findings from 2013 to January 2015. Including sizing the UK market, invoice finance for fast-growing businesses and new startups; client life; customer satisfaction differences and mystery shopper invoice finance pricing results.

- Mystery Shopper Full Report - August 2014 - a full report of the findings from our invoice finance mystery shopper pricing survey.

- Mystery Shopper Summary Report - August 2014 - a summary of our mystery shopper study amongst our panel of confidential invoice discounting, recourse factoring and non-recourse factoring companies to find the top 3 cheapest quotes for each product.

- Invoice Discounting Clients Survey Findings - March 2014 - A survey of 54 existing invoice discounting clients that were asked to rate and review their invoice discounter.

- Factoring Clients Survey Findings - March 2014 - A survey of 46 existing factoring clients where they were asked to rate and review their factoring company.

- Invoice Finance Market Research Summary Part 3 - the 3rd part of a summary of our historical research findings. Includes preference for a tariff of charges vs. fixed fees and detailed research regarding construction finance and funding against applications for payment within the construction sector.

- Invoice Finance Market Research Summary Part 2 - the 2nd summary which covers: raising the profile of invoice finance; what is missing from the IF market?; what customers don't like about invoice finance; what they expect to pay for invoice finance, and how clients suggest we promote these products.

- Invoice Finance Market Research Summary Part 1 - the 1st summary which covers: the potential size of the invoice finance market; why more businesses don't use invoice finance; the 8 most well-known invoice finance companies; who is most actively marketing; research regarding bank overdraft; how businesses choose their invoice finance company and their detailed pricing expectations.

Research-Related Published Articles

- External Finance Use Increases - The Q2 2019 SME Finance Monitor from BVA BDRC reports an increase in the use of finance.

- Creative Sector Late Payments - Research by Kriya about late payments in the creative sectors.

- Late Payment Problem? - Pulling together various pieces of research about UK late payments amongst SMEs.

- Comparison of Pricing And Funding Levels - a comparison for a Confidential Invoice Discounting client.

- The Economic Impact Of Brexit On UK Late Payments - a survey of the opinions of UK companies.

- Changing Invoice Finance Companies - why product choice influences the propensity to move between providers.

- Reasons For Non-Payment In The Construction Sector - why construction sector businesses fail to get paid.

- Awareness Levels of Receivables Financing - findings of the low levels of awareness of these cash flow products.

- Recruiters Still Not Considering All The Funding Options - Many recruitment companies are still not aware of these options.

- Sources of Funding Used By Recruiters - how recruiters tend to finance their businesses.

- Recruiters Want Customer Late Payments To Improve - How late payments are affecting the sector.

- Construction Sector Financing Market Research - summary of our findings regarding the construction sector.

- Why Invoice Finance Works For Manufacturers - how manufacturing companies can benefit from debtor finance.

- Advertising of Crowdfunding, Payday Loans & IF - article highlighting the levels of awareness of alternative finance.

- Users 7 Times More Aware Of Payday Loans Than Invoice Finance - comparative between loans and receivables finance.

- What Stops Invoice Finance Users from Moving Providers? - the barriers to moving between factoring providers.

- 71% Don't Want To Change Invoice Finance Companies - findings of satisfaction levels amongst those using IF.

- Advertising Invoice Finance Versus Crowdfunding - comparative with crowdfunding.

- 53% Recommend Invoice Finance For New Startups - startup finance that is freely available and often overlooked.

- Confirmed - 87% Say Using Invoice Finance Enabled Growth - how debtor finance has enabled business growth.

- 96% Think Use Of Invoice Finance Will Tackle UK's Late Payment Culture - tackling late payments in the UK.

- 15.5 Years - Average Age Of Invoice Finance Users - the average client life within this sector.

- Quotes From The 98% Of Users Recommending Invoice Finance - what existing users say.

- Overdraft Versus Alternative Finance - The Gap Narrows - Alternative finance becomes more available.

- Invoice Auction Sites And Selective Invoice Finance - views on selective and invoice auction sites.

- Switching Between Invoice Finance Companies - moving providers.

- 47% haven't Seen Any Invoice Finance UK Advertising - low levels of advertising awareness.

- What Percentage Of Existing Users Would Recommend Invoice Finance? - views from existing product users.

- The Reasons Non-Bank Introduced Users Picked Their Facility - why customers choose their facilities.

- How Businesses Find Invoice Finance - routes to find debtor financing.

- How To Improve Your Invoice Finance Facility - suggestions for invoice financing companies.

- The Answers - How To Increase Invoice Finance Client Numbers - ways to grow the sector.

- Revealed - Why Clients Pick Particular Invoice Finance Facilities - choices between facilities explored.

- Why More Businesses Don't Use Invoice Finance - the reasons 1% of UK businesses use receivables finance.

- Business Finance Market Research Results For Fast-Growing Businesses: www.ezinearticles.com/?Business-Finance-Market-Research-Results-For-Fast-Growing-Businesses&id=8529743