The Myths About Factoring For Recruiters - Debunked

Following my article debunking myths about invoice finance for recruiters, this one looks at some of the misunderstandings and myths about factoring for recruiters. I have included an infographic that sets out these myths.

Factoring is one route, but it sits under the wider umbrella. For a full overview of the options for recruiters (including payroll finance and confidential setups), see our main recruitment invoice finance page.

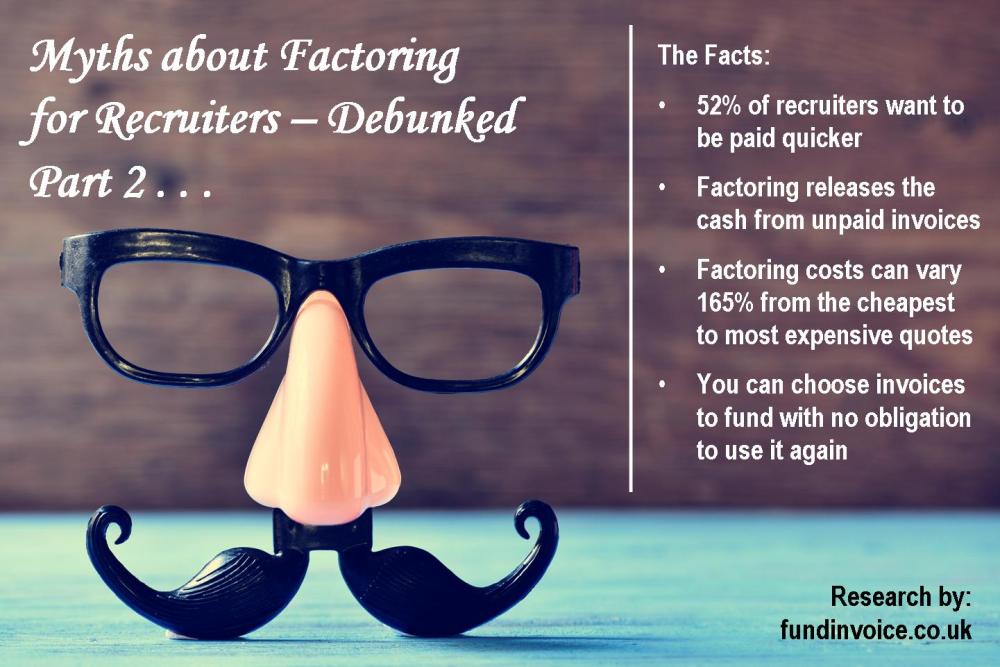

Factoring Myths - Infographic

Myth 1 - Recruiters Get Paid Quickly

Gone are the days when recruiters tended to be paid by customers on very short credit terms. Credit periods have dragged out and payment delays are common. Things are now so bad that our research found that 52%, of recruiters that we surveyed, said that they wanted late payments to be addressed so that they were paid more quickly.

Myth 2 - Better Credit Control Is The Only Option If Customers Don't Pay

One way of speeding up payments from customers may be improving your own credit control procedures, which could improve your debt turn by getting payments in quicker. Perhaps by pre-dunning, where you contact a customer before an invoice is due, you might see a slight improvement. However, many companies stick to regular payment patterns, and that can mean having to wait. For example, some pay the month following receipt of the invoice on a set day each week - that's just the way they operate, and no amount of chasing will change that.

As an alternative, you could use a factoring company to bridge the payment gap. The recruitment factoring company will provide prepayments against your sales invoices when you raise them, effectively releasing the majority of the value of your invoices into working capital immediately.

In addition, many companies find that factors are better at collecting money and can speed up their debt turn as they tend to employ highly skilled, professional credit control staff that knows every trick in the book and how to overcome payment excuses.

Myth 3 - Factoring Is Expensive

It doesn't have to be. Factoring prices start from a single fee per annum to fund against all your invoices, or you could just select invoices that you want funded and pay just for those, without any obligation to fund more invoices.

However, our research has revealed that there are dramatic differences between the cheapest and most expensive factoring quotes. We found a 165% swing between the cheapest and most expensive in a recent mystery shopper exercise. This means that you could end up paying 2.7 times more than you need to if you pick the wrong factoring company.

Myth 4 - You Will Be Tied Into A Contract

Not necessarily. If you don't want to factor all your invoices, then you can use what is called selective, or spot, factoring, which typically does not have any contractual lock-ins. You just pick which invoices you want to finance against and submit those, with no obligation to keep using them.

Even if you want all your invoices funded, many factors now offer short notice of termination periods and not all will place a minimum turnover requirement on your business.

Conclusions & Further Help

Hopefully, that has laid to rest a few of the many misconceptions that we have come across.

If you would like any further help finding a suitable factoring company, please contact us or call Sean on 03330 113622.

Source: East Sussex & Kent Recruitment Finance Survey (100 Respondents) - June 2016 & Factoring Prices Mystery Shopper Study January 2017