What Is Trade Finance & Import Finance?

Trade Finance (also known as Import Finance or Purchase Order Finance) can provide your business with:

Trade Finance (also known as Import Finance or Purchase Order Finance) can provide your business with:

- Import finance - to fund imports of goods and stock from abroad, or for UK transactions.

You can either repay the funding after an agreed period or use:

- Invoice Finance - to repay the cost of import finance, and to help collect your invoices (if you prefer).

FundInvoice LLP deals with several well-known trade finance providers and we offer an independent quotation search service that you can use:

How Does Trade Finance Work?

It can work in a variety of ways but the key aspect is that we can help you, as the importer, raise money to pay your supplier(s) in respect of goods that you are importing from abroad. Some providers will also offer trade facilities in respect of transactions that are based entirely within the UK.

We can also help with cross-border transactions, where the goods move from one foreign territory to another. This type of import financing facility enables you to pay your supplier on time whilst receiving extended credit terms.

In some cases, the financier can help with all aspects of the cycle, including shipping and production inspections, and customer payments.

We have access to specialist trade financing houses that are experienced in all aspects of international import financing such as letters of credit, bills of exchange and other importation documentation. We can introduce you to one or more providers that meet your requirements.

Pre-shipment finance is also available, to make payments to overseas suppliers in advance of manufacturing and shipping.

See our more detailed guidance on trade financing support for importers.

The Cost of Trade Finance

The cost of trade finance depends very much upon your requirements and circumstances and the type of facility that you need. In some cases, a flat fee structure can be offered.

This is an example of a trade finance price that we found for a client.

We can find quotations for you so please contact us for a confidential, no-obligation consultation with an experienced adviser:

REQUEST MY TRADE FINANCE QUOTATION SEARCH or call Sean on 03330 113622.

The Benefits Of Import Finance

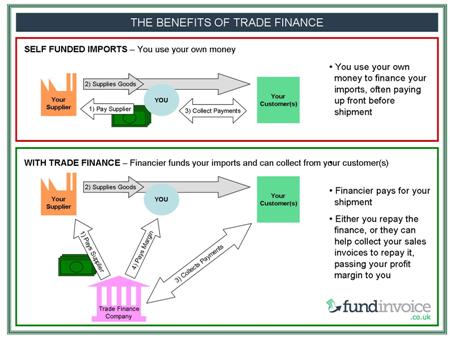

Trade and import finance will bridge the gap between having to pay your supplier and being able to receive the goods or stock and sell them to be paid by your customers.

Some other benefits are:

- It may enable you to receive better terms from your suppliers as you are effectively able to pay upfront for supplies.

- You may be able to pass on those cost savings to your customers, enabling you to lower your prices and become more competitive.

- Larger orders may be possible, achieving economies of scale that could lead to further cost savings.

- Smoothing out cash flow and liquidity issues for your business.

- The funding can be based on the security of the underlying goods and the quality of your debtors. This means it can be accessible to businesses that are not in a strong financial position.

- Aspects of the service can help protect your business against risks such as bad debts and paying for incorrect shipments.

Further Resources

- List of Trade Finance Companies In The UK - a list of providers from our panel with contact forms so that you can request that they call you back.

- Article - About Letters Of Credit

- Case Study - How we have coupled Trade Finance With Factoring For Importers

- Infographic - The Benefits: