- 01 Mar

Growth Guide How To Grow Your Business

Business growth is the objective of most organisations and this guide seeks to help you expand and grow your business.

We are heavily involved with fast-growing companies so we have a wealth of experience in achieving and funding expansion. There are many business growth-related resources on our site and others, so in this post, we have pulled together this free business growth guide to summarise all the links, help and support into one place.

Business Growth Guide

If you are seeking ideas about how to grow and expand your business, this free business expansion guide may help give you some ideas about how you can achieve business growth.

If you are seeking ideas about how to grow and expand your business, this free business expansion guide may help give you some ideas about how you can achieve business growth.Marketing Toolkit & Templates

Glenn Blackman MBA is one of our partners with a background in marketing consultancy. He is responsible for our own business marketing and has produced THE GROWTH MARKETING PLAYBOOK that you can use to develop your own business without spending much money.

Additional Resources

With a large number of UK SMEs expecting to grow this year, there is some degree of confidence within the UK. The following additional resources may give you some helpful ideas for strategies or campaigns that you can implement within your own business, and if needed we are available to help you finance that growth.

Guide To Marketing

Please see our free, comprehensive guide to marketing a UK business.

Ideas To Help Grow Your Business

We have published a list of possible strategies for growth that fit within a number of simple categories. This article sets out all the possible options available to a business that wants to expand, both at a strategic level and a tactical level. For example, growth strategies might include selling more products to your existing customers or finding new customers. Tactics could include developing a third-party seller network or changing your pricing approach. The article sets out all the various approaches.

Improving Sales Performance

If sales are an issue and you want to close more deals, Glenn has co-authored and published a book: "Selling Without Shaking Hands - How To Sell From Anywhere". The book explains a simple "Tipping Point Sales System" that anyone can use to improve their sales conversion ratio. It is available from the Amazon bookstore.

Marketing Ideas

Previously we also put forward some marketing ideas to Grow The Success Of Your Business. This article sets out how we approach our own marketing, and how you can apply the same type of thinking to your own situation.

We have also published some further marketing ideas about keeping in touch with prospects and using social media. This includes how to maintain an ongoing contact programme with your customers, and how you can leverage social media to keep in touch with your customer base, and new potential customers.

Startups

As part of our guide to setting up a new startup business, we put together a guide to marketing for startups which includes some helpful thoughts about how you should go about developing a marketing plan. It covers market segmentation, defining your value proposition and analysing your competitors. It goes on to set out a full range of marketing approaches so that you can pick those that are likely to be the most effective for your situation.

We also produced some material for entrepreneurs that might be helpful, and which includes some thoughts about how to develop strategic ideas and strategic thinking. It is based on a presentation that Glenn gave to a group of students that were interested in how entrepreneurs think.

Funding Business Growth

Once you have planned how you want to expand your business, you will need to decide how you are going to fund the journey towards your goals and objectives. There is a wide range of methods of funding a business, and we have previously looked at the types of funding that growing businesses tend to use.

See our related article on Scale-Up Finance.

Growth Finance

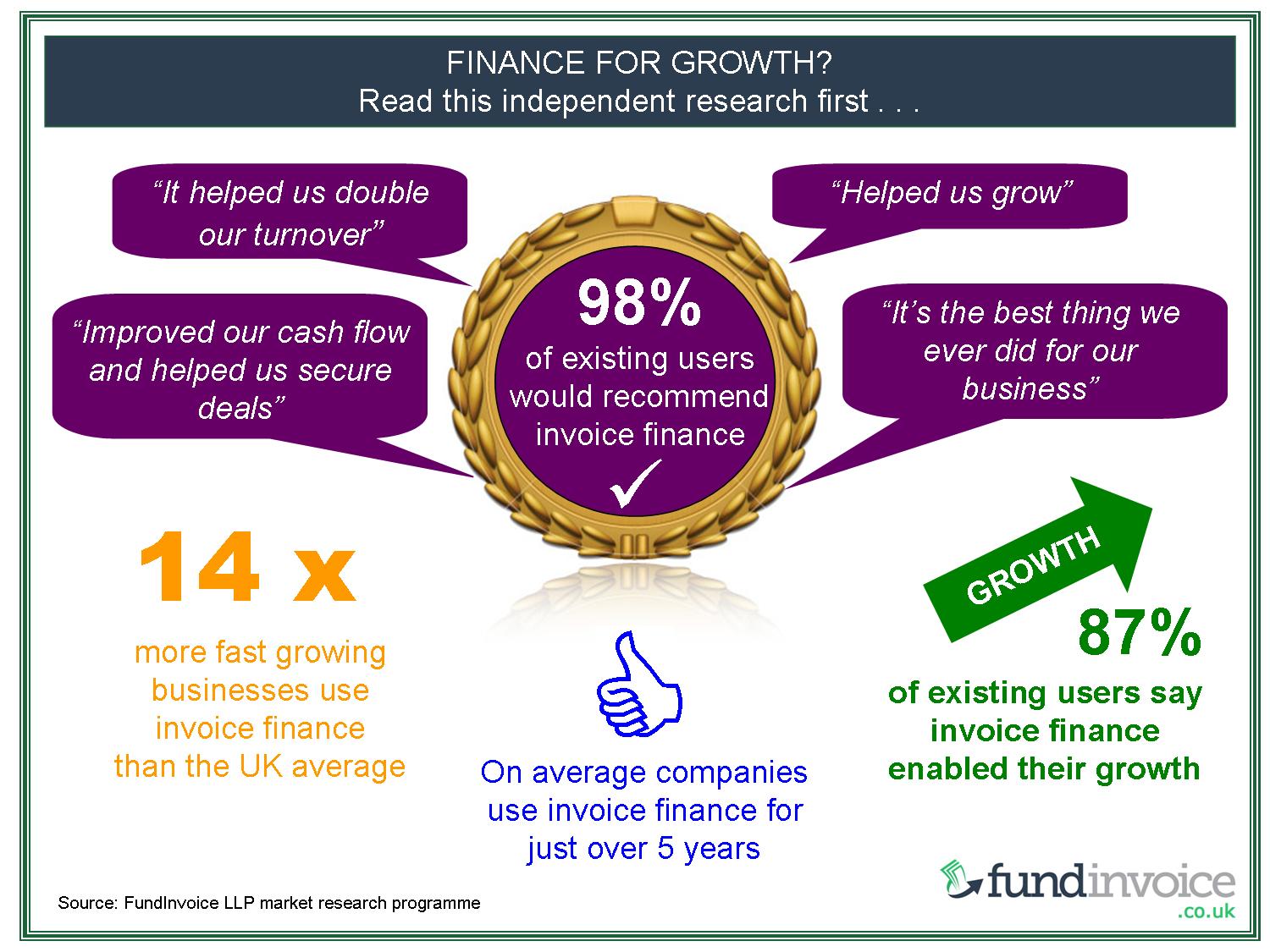

One funding method that is closely linked to fast growth is the use of invoice or receivables financing. This is often called "growth finance" as it is closely allied to fast-growing companies that need to smooth out their cash flow in order to maintain their expansion. In fact our research has identified that there is a high correlation between fast-growing businesses and the use of invoice finance. In addition, some 68% of existing users said that they would recommend receivables finance to fast-growing businesses.

Read about how invoice finance can help your business to grow.

Large Orders

If you are contemplating accepting a large order, this type of funding can be particularly useful in enabling you to fund a large order or project. Being able to take on a large order is one way of achieving "step change" style growth. This means a significant upscaling of your company, rather than slow organic, natural expansion.

Using Invoice Finance To Support A Growing Business

The graphic below shows some of the key facts about the linkage between the use of this type of funding and increasing your trading volumes:

Acquisition Finance

Acquisitions are another way of growing your business, acquiring the trade, debts or business of another entity and amalgamating that into your own business. This can be one way of achieving a quick step change in terms of growth. Many people don't realise that you can leverage the assets of the company that you are buying, using receivables finance, to help fund its acquisition.

The funding of acquisitions is something that receivables finance can play a part in. Our post about how to leverage assets to enable acquisitions could present an interesting way of raising the price of a business acquisition, utilising the assets of the target company.

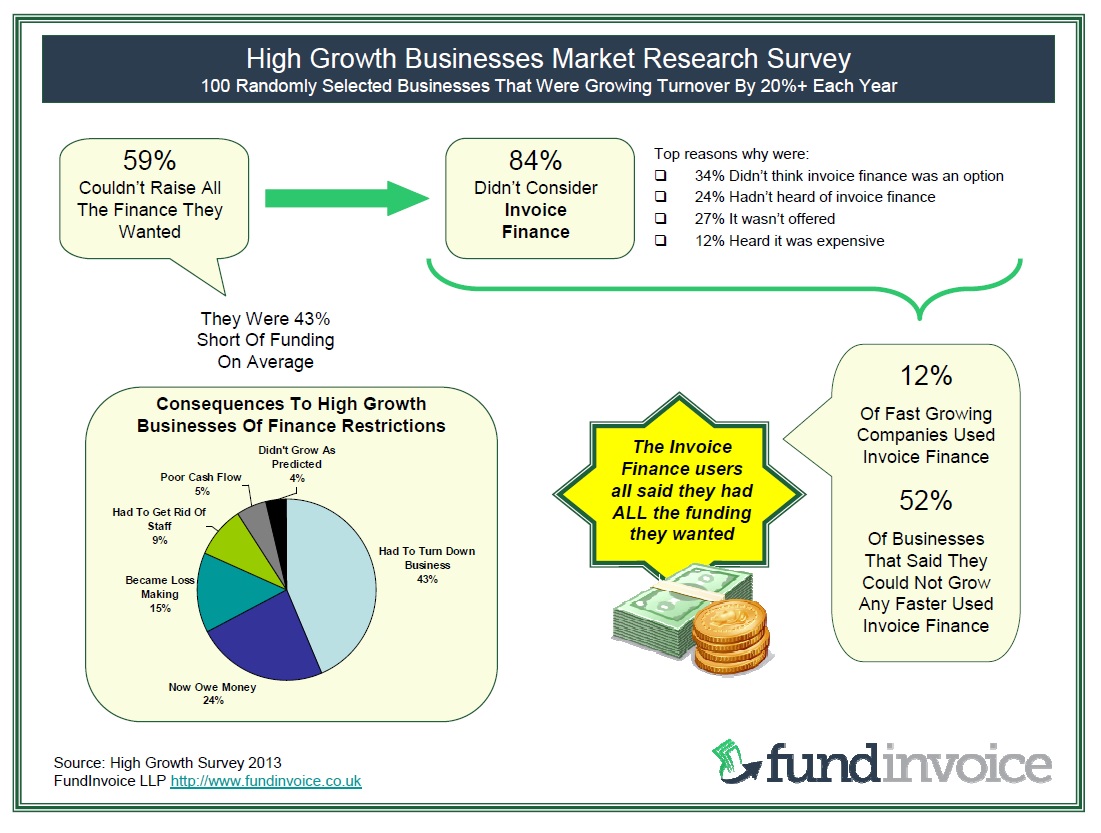

Growth Funding Research

The following infographic summarises the findings of our research amongst high-growth companies:

Customer Finance

One aspect of funding is how you can sell more by offering finance to your customers. In an article from an external contributor, the idea of extending third-party finance to your customers, in order to sell more products, is explored.

How To Grow Your Business

We hope that this summary guide will help you decide how to grow your business, and also help you consider how you can finance that expansion. An important part of your planning is the setting out and defining: goals, strategies, objectives and tactics that will help you know where you are aiming to get to, and when you have achieved what you set out to achieve.

Goals - Strategies - Objectives - Tactics

These can be defined as follows:

- Goals - a broad aspiration e.g. "to become the biggest UK supplier of".

- Strategies - the approaches that will get you to achieve your goals. For example: "develop our third-party introducer network".

- Objectives - are the measurable steps on your path e.g. "recruit 50 introducers in year one".

- Tactics - are the steps to achieve your objectives e.g. "attending the local networking event each month".

Whilst defining these is important, the most important thing is providing products and services that are in demand, which ensures a profitable outcome for your business.

- Goals - a broad aspiration e.g. "to become the biggest UK supplier of".

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog