Invoice Finance For Recruitment Companies

Recruitment invoice finance is designed specifically for recruitment agencies that must pay wages weekly while waiting 14 to 60 days (or more) to be paid by clients. It is most commonly used by recruitment firms placing temporary staff, contractors and PAYE workers, where payroll must be met long before invoices are settled.

Often referred to as payroll finance within the recruitment sector, this type of funding allows recruiters to release cash tied up in unpaid invoices to cover wages, PAYE, National Insurance and operating costs without relying on overdrafts or personal guarantees.

Recruitment invoice finance works for temporary and permanent placements and is used by both established agencies and new startup recruiters.

- Pay weekly wages and PAYE while waiting to be paid by clients

- Release cash from signed timesheet invoices immediately

- Funding grows automatically as your turnover increases

This form of invoice finance is particularly effective for recruitment agencies with ongoing payroll commitments and clients that pay on credit terms.

GET A RECRUITMENT FINANCE QUOTE

(without obligation) or call Sean on 03330 113622

Finance For Temporary Placements & Permanent Placements

Recruitment invoice finance is available against temporary placements and permanent placement invoices. It can help both established and new startup recruiters, where funding against their payroll can be vital to maintaining good cash flow.

Recruitment invoice finance is available against temporary placements and permanent placement invoices. It can help both established and new startup recruiters, where funding against their payroll can be vital to maintaining good cash flow.

Payroll Finance vs Recruitment Invoice Finance - What’s the Difference?

In the recruitment sector, the terms payroll finance and recruitment invoice finance are often used interchangeably, but they are not always the same thing.

Recruitment invoice finance refers to funding against unpaid sales invoices raised for temporary or permanent placements. A finance provider advances a percentage of the invoice value, allowing recruiters to access cash quickly while waiting for clients to pay.

Payroll finance is a more specialist form of recruitment finance that typically combines invoice funding with additional services such as payroll processing, PAYE and NI calculations, and sometimes credit control. This is particularly popular with recruitment agencies that place temporary staff and need a fully managed back-office solution.

Some recruiters prefer payroll finance because it removes the administrative burden of running weekly payroll, while others opt for invoice finance without payroll services to retain control and keep costs lower. The right option depends on your placement mix, internal resources, and growth plans.

We help recruitment agencies compare both options and choose the structure that best fits their business, rather than forcing them into a one-size-fits-all solution.

Payroll Finance Is Used By Many Staff Agencies In The UK

In fact, our research (see below) found that 17% of staff agencies in the UK use this type of finance. This is more than 20 times the national average - by our estimation, so payroll finance is very popular with staff agencies.

Lots Of Recruiters Choose Payroll Finance

Recruiters constitute the second largest industry sector currently using these products to fund their business growth.

More Information About Finance For Recruitment Companies

This page pulls together all the relevant resources and information about finance for recruitment companies, staff agencies and recruiters based in the UK.

For a deeper look at how specialist recruitment funding works in practice, including payroll cycles, margin protection and common pitfalls, see our guide to payroll finance for recruitment companies.

Recruitment Company Finance

Recruitment companies often face cash flow challenges due to the nature of the recruitment cycle. Placing candidates and invoicing clients creates a time lag between paying your staff and receiving payments from clients. This is where Recruitment Company Finance becomes an invaluable solution.

Recruitment Funding Solutions

Recruitment Company Finance refers to a range of financial services tailored specifically for recruitment agencies. These recruitment funding solutions include:

- Payroll finance - funding against your receivables with the addition of payroll management services and credit control if required

- Business loans - a loan can be standalone or added to other recruiter funding options to generate more funding than from a single source alone

- Asset finance - larger agencies with assets such as property or equipment may be able to raise additional funds against these tangible assets

- Export finance - this may be applicable if your agency makes international placements outside of the UK

By leveraging these recruitment finance solutions, recruitment companies can focus on their core operations, such as placing candidates and growing their client base, while leaving cash flow concerns in the hands of finance experts.

Use the button below to arrange a call back to discuss the available financing options.

Funding Temporary Invoices As Essential Support for Recruitment Agencies

For recruitment agencies focused on placing temporary staff, managing cash flow can be particularly challenging. The need to pay temp workers weekly, while clients may take weeks or even months to settle invoices, creates a financial gap that can strain resources. Funding temp invoices allows agencies to release cash from unpaid invoices quickly, helping to fund wages, PAYE and operational costs without delay.

Funding temporary staffing invoices offers a tailored solution to bridge this gap, ensuring that your agency can cover wages and operational costs without delay. By securing invoice finance specifically for temp and temporary staffing invoices, you can unlock cash flow based on outstanding payments, allowing your business to grow without being held back by extended client payment terms.

This type of invoice funding can be especially valuable for agencies experiencing rapid expansion, as it scales with the volume of temporary placements with improved cash flow from funding contract staff invoices.

Whether you’re placing temps in high-demand roles or managing seasonal staffing demands, funding solutions for temp invoices help sustain your operations and provide the flexibility to take on new contracts confidently. This form of finance enables you to focus on expanding your agency and fulfilling client needs rather than chasing payments or worrying about cash flow gaps.

How Funding Temp Invoices Works for Recruitment Firms

The process for funding temp invoices is straightforward and tailored to the operational needs of recruitment firms. Once you issue invoices for temporary placements, a finance provider advances a percentage of the invoice value, often within 24 hours.

This immediate injection of cash flow not only supports payroll but also helps cover recruiting, training, and administrative costs. It’s a vital financing tool that frees you to concentrate on agency growth and client service instead of cash flow bottlenecks.

Invoice finance solutions for temp staffing agencies often include credit control services, so your team spends less time chasing payments and more time sourcing candidates and fulfilling client expectations.

By funding temp invoices using temporary staffing finance, you not only enhance cash flow but also streamline your operations for a smoother, more efficient business model.

Read about how we helped one driver recruitment company.

Common Problems Recruiters Face And Their Solutions

The nature of the trade in this sector is such that there are normally wages to be paid and low levels of assets to secure traditional types of bank lending, such as overdrafts and loans. The rate of growth can also be very fast, which can make traditional products less suitable. Sales finance does not require assets, other than sales invoices, as security, and the amount of funding grows in line with turnover growth.

Recruitment finance can be provided without concentration limits, even if you only have one customer. Prices vary, but can be very simple, even using a single-fee pricing structure.

These are common problems and their solutions:

- Needing sales invoices paid quicker - invoice finance releases money (often up to 90% - more in some cases) against sales invoices before they are paid. This funding against temp invoices can be in respect of all invoices, on an ongoing basis, or you can select the invoices that you want to be funded without being tied in. You can use the money released for any purpose, including paying wages, PAYE and NI. We can help you by finding funding for you.

- Needing help managing your payroll - you can outsource the complete management of your payroll.

- Not wanting to do the back-office administration - we can also help you outsource all of your back-office functions, if you wish, from the setup of a new recruitment business through to the accounting and administrative paperwork of an existing company. You could be in a position to focus purely on finding and placing candidates, with someone else handling all of the other administrative functions on your behalf if you wish.

- Needing help with credit control - you can outsource your credit control function, or use factoring, which combines funding with credit control.

- Raising finance against RPOs - sometimes there are restrictions on the level of funding available against invoices to certain RPO organisations. These are also known as "neutral vendors". We have funders that will finance RPO invoices, alleviating these restrictions.

- Needing finance against up to 100% permanent placements - whilst funding temp placements is commonplace, financiers that will handle permanent placements are less common, due to the rebates that can be involved. However, we have partners that will finance up to 100% perms.

- Wanting an alternative to Pay and Bill recruitment outsourcing services to reduce costs and the amount of control of your business that you give up to an outsourcer

You can outsource just about all aspects of your business if you wish, so that you are free to just focus on making sales, i.e. staff placements, and someone else does all the back-office processing for you.

Qualification Criteria For Funding

The labour recruitment and provision of personnel SIC code group is very much suited to the use of receivables financing. Signed timesheets in respect of temporary staff placements make those debts very clearly provable, which is very attractive to invoice finance companies. Hence, they like to fund against those types of invoices.

Providing you are invoicing on credit terms, there is a high likelihood that you will be approved for funding:

- Even if you have a previous adverse credit history, including CCJs (County Court Judgements), or being in a CVA (creditors voluntary arrangement).

- Even if you are not a homeowner.

- Even if you are a new startup company with no trading history.

Criteria do vary between providers, but we can introduce you to sympathetic funders.

When Recruitment Invoice Finance May Not Be the Right Fit

While recruitment invoice finance is highly effective for many agencies, it is not suitable for every business in every situation. In some cases, alternative funding options or a simpler approach may be more appropriate.

- Agencies that invoice on immediate or very short payment terms and do not experience cash flow gaps.

- Recruitment businesses with very low or irregular invoice volumes. Financing invoices selectively might be an option in these cases.

- Agencies that operate entirely on cash or advance payments rather than credit terms.

- Businesses that are uncomfortable with a third party being involved in invoice processing or collections.

- Recruiters whose clients have a history of persistent payment disputes or unresolved contractual issues.

If recruitment invoice finance is not the right fit, we can help you explore alternatives, such as business loans, selective invoice funding, or other funding structures that better match your operating model.

For a broader explanation of how invoice finance works across all UK sectors, see our Invoice Finance overview.

Recruitment Invoice Finance Pricing

The pricing will vary between providers and facilities. You can read an explanation of the costs and if you contact us we can check the specific pricing for your company without harming your credit rating or alerting any existing provider.

How Much Money Could You Raise?

Use our invoice finance cash calculator to estimate the amount of money you could raise through this type of funding.

Case Studies Where We Have Helped

We have many years of experience in financing recruitment companies in the UK. These are case studies specifically about the many staff placement sector companies that we have helped:

- Overcoming RPO and neutral vendor funding restrictions

- Payroll Solutions Case Studies - using payroll support to run your payroll for you.

- Recourse Factoring For A New Start Recruiter - finance for new companies that might not be eligible for a bank overdraft.

A Testimonial From A Recruiter That We Found Payroll Finance

This is a testimonial from a recruiter that we found a payroll finance facility. They rated FundInvoice 5 stars out of 5 and said this about the specialist they spoke to at FundInvoice:

"Sean has provided us with a fantastic service in helping our business find a new recruitment factor and provide key information on two recruitment vendors that have helped move our business in the right direction.

Sean gave us a quick and helpful solution, all whilst providing an excellent service and constantly staying connected to ensure our business found the right solution. I could not recommend speaking with Sean highly enough."

You can speak to Sean about your requirements on 03330 113622.

Payroll Finance Companies

There are over a hundred UK invoice finance companies, and most will happily deal with finance for employment agencies.

However, there is a more select list of payroll finance companies that are specialists and offer tailored employment agency finance packages. Our team can connect you with such specialists.

Other Resources For Staff Agencies

These are further related resources that may be helpful.

Comparison Table Of The Finance Options For Recruiters

This is a comparison table of the common finance options for recruiters:

| Finance Option | Pros | Cons | Costs | Funding Limits | Best For |

| Payroll Finance | Package of services Includes funding Includes payroll Tailored for sector Grows with you |

Don't manage own payroll Don't collect own invoices |

Small % of invoices Discount fee, any CPE & discount normally bundled into one service fee Ancillary fees possible |

100% of your |

All recruiters New starts Existing firms |

| Factoring | Includes funding Includes credit control Grows with you Easy to access |

Payroll is an add-on May not be sector-specific |

Small % of invoices Discount fee on funds Ancillary fees possible |

Up to 95% of invoices |

New starts |

| Invoice Discounting | Funding only Can handle own admin Grows with you |

No admin outsourcing | Small % of invoices Discount fee on funds Ancillary fees possible |

Up to 95% of invoices |

Established firms |

| Bank Overdraft | Finance only Easy to understand |

Doesn't grow with you Harder to access Often limited amounts |

Interest rate & margin Ancillary fees possible |

Fixed amount | Established firms |

| Bank Loan | Set amount Easy to understand |

Doesn't grow with you Repaid over time Funding decreases |

Interest rate & margin Ancillary fees possible |

Fixed amount | Established firms |

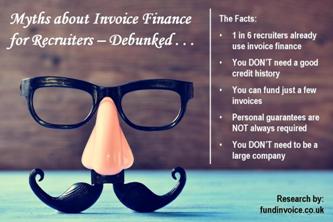

Infographic About Invoice Finance For Recruiters

This infographic relates to common myths about invoice finance, debunked for recruiters:

- Blogpost - Recruitment Factoring Companies

- Article - Many Recruiters Still Overlook Receivables Finance

FAQ: Recruitment Invoice Finance

1) What is recruitment invoice finance?

Recruitment invoice finance allows agencies to unlock cash tied up in unpaid invoices, providing immediate working capital to cover operational costs like payroll, marketing and other expenses. It is a great way to finance a recruitment company that will support its expansion and growth.

2) How does it work?

You submit your invoices to a finance provider, who advances a percentage of the invoice value (usually 80-90% but it can be even higher in some cases). When the client pays, the balance is released minus fees.

3) Is invoice finance suitable for temporary staffing agencies?

Yes, it’s particularly beneficial for agencies dealing with high volumes of temporary placements, as it smooths cash flow to meet payroll demands.

4) What are the costs involved?

Costs can vary based on the finance provider, the creditworthiness of your clients, and the size of your invoices. See our guide to costs for examples and typical ranges of fees. Contact us for quotes specific to your circumstances (in confidence, without affecting your credit file and without any obligation to proceed).

5) Can I still manage my client relationships?

Yes, most providers offer confidential options, allowing you to retain control of client communications.

6) What happens if my client doesn’t pay?

Some providers offer non-recourse options, where the provider bears the risk of non-payment should the debtor become insolvent in return for an additional fee.

7) How quickly can I access funds?

Once set up, you can typically access funds within 24 hours of submitting invoices.

8) Is there a minimum or maximum funding limit or criteria?

Funding limits are flexible and depend on the value of your invoices. There is no real minimum or maximum criteria, some very large businesses use this financing option and you can use it for individual invoices making it accessible to the smallest of firms.

9) How do I apply?

You can apply directly through a finance provider but FundInvoice offers a broker service. The benefit of using our service is that we will do all the work to search the market for you. This gives you access to a full range of tailored options and guidance from experienced professionals.

The application process usually involves providing some simple details about your business and outstanding invoices.

10) Can invoice finance grow with my business?

Yes, invoice finance is scalable. As your sales grow, the amount of funding you can access typically increases proportionately.