- 16 Nov

Invoice Financing Process Explanation

Explaining the invoice financing process is not as simple as a single process flow that explains all the steps. Different invoice finance companies will have different processes. Even products can work differently within a single provider company. Therefore, this post will give you a broad overview of the process and some of the different steps that you might come across.

Invoice Financing Process Explanation

The process is split into three parts, the sales process, the operations process and termination.

Sales Process

The sales process is a series of steps to acquire a new customer. This starts with the initial contact between the customers and the invoice finance company. The process ends when the customer is "paid out". This is pretty much universally considered the point at which a new customer becomes an active account. However, some organisations will define this as the point at which the facility is all setup and ready to go, prior to the release of any money - this is a very small minority.

This post explains the typical invoice finance sales process.

Operations Process

The operational process is everything that happens after the completion of the sales process. This includes how invoices or the sales ledger are transmitted to the funder, how payments are requested and how other aspects of the facility work.

Termination Process

Termination is the procedure through which the facility ends. This is either instigated by the funder or their client. See our Guide To Invoice Finance Termination. Some funders are members of UK Finance or similar bodies. UK Finance members abide by a common code of practice and have standardised termination procedures.

Procedural Differences

While invoice financing procedures tend to be similar, there are differences between different providers and products. This video describes the basics of what these products are all about:

For more details about these products, see our Free Guide to Receivables Financing.

The underlying processes will be very different depending upon the type of invoice financing product that is being used. With invoice discounting or invoice finance, the facility may deliver funding only. Factoring will include a credit control service and there may be other added services such as bad debt protection, or payroll management.

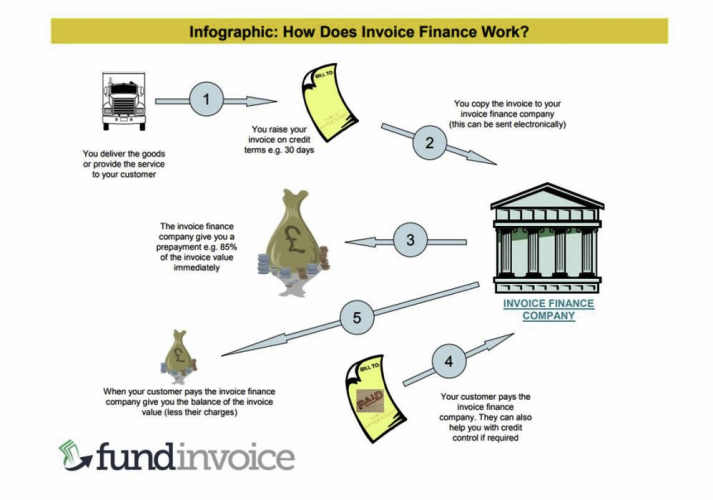

This diagram gives you an overview of a typical process flow:

Invoice Transmission

The method by which invoices or sales ledger balances are transmitted varies. In some cases, a full sales ledger will be constructed and maintained by the funder. Typically, this will be for factoring-style services where the funder undertakes the credit control. For some invoice discounting facilities, the funder will only maintain control balances, i.e., the sales ledger total value. This will be adjusted as new invoices are submitted for funding and payments are received. A regular reconciliation may be undertaken or required, to match your figures to those of the discounter.

Invoice Upload

Most providers have the facility for you to upload your invoices electronically (historically, this was a paper schedule of debts in the post). This may be by the transmission of a file or an extract from your accounting software.

Sales Ledger Upload

Some funders have a full sales ledger upload capability. This means that a piece of software extracts your full sales ledger from your accounting software and uploads it to the funder. In some cases, you don't need to conduct any type of reconciliation as sophisticated software is used to automate this task.

See also this related case study: Simplifying Providing Information Using Technology.

Payments

Typically, each funder will have some type of app or website through which you can manage your account (historically, this was via the telephone). This interface will allow you to request the drawdown of funds to your bank account. Many of these interfaces offer extensive additional functionality for the user.

Fees and Charges

Once again, the level and structure of fees and charges will vary between providers and products. See our guide to how Charges & Fees typically work and what they are likely to cost.

Account Management

Most receivables financing companies have account managers who look after their client accounts. They are likely to be your first port of call if you have a problem or an issue. Their responsibilities often encompass maintaining the relationship with you, ensuring the quality of the service delivery, and managing the risk associated with funding provision. There may be a requirement for regular audits on your account, particularly if you are using invoice discounting. These are often conducted quarterly and normally involve a site visit to review your accounting records. In some cases, they may be conducted remotely.

The quality of the service provided will vary between providers. This will range from dedicated local staff handling your account to overseas call centres dealing with your queries. The same is true of the credit control service in the case of factoring. In some cases, it will be a comprehensive service, in other cases, it is more of a risk control mechanism where contact is only made with your larger accounts. These factors mean it is important to take care when selecting an invoice finance company.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog