Debt Factoring Explained

Important: In the UK, debt factoring is commonly used as another name for invoice factoring. This page explains the term's meaning and how it is typically used in business conversations. For a full overview of factoring options, pricing, and an independent quote comparison, see our main Invoice Factoring page.

What does "debt factoring" mean?

Debt factoring generally refers to a business using a factoring provider to release cash from unpaid invoices (accounts receivable). The provider advances a portion of the invoice value (a prepayment), and collections and administration may be handled by the provider, depending on the facility's setup.

In other words, debt factoring is not usually a separate product from invoice factoring. It is simply a term people use to describe the same service, phrased slightly differently.

Debt factoring in business (simple definition)

A debt factoring arrangement typically involves:

- The business submits invoices (or other approved receivables) for funding, often electronically.

- The provider makes a prepayment available against eligible items.

- Credit control and collections may be handled by the provider (or conducted in your name if the facility is confidential).

- When the customer pays, the prepayment is cleared, and the remaining balance (less fees) is released.

In some sectors, the receivable may not be a standard sales invoice. For example, in construction, it may involve items such as applications for payment, depending on the facility structure and provider policy.

Why businesses use the term

Businesses often use the phrase "debt factoring" when they are focused on the cash flow outcome, releasing working capital tied up in debts, rather than the product label itself. The aim is usually to reduce the wait for payment terms to end and to keep the business funded as it grows.

If you are comparing factoring with other options, our cash flow guide is a useful starting point.

Common reasons companies look at debt factoring

- Immediate cash flow improvement: turn credit sales into working capital, helping with wages, supplier payments, and day-to-day outgoings.

- Administrative relief: the provider can handle collections and ledger administration, depending on the service level agreed.

- Funding that scales: availability often grows as invoice volumes increase (subject to controls such as debtor limits and eligibility rules).

Note: facilities differ materially between providers, particularly around eligibility rules, debtor limits and how availability is calculated. Two facilities described in similar terms can still behave very differently in practice.

A quick process example

A typical debt factoring process can look like this:

- Submission: invoices are submitted to the provider (often via upload or software integration).

- Prepayment: funding becomes available once invoices are approved.

- Collection: the provider manages collection activity where required.

- Settlement: when the customer pays, the balance is released after fees.

Choosing the right provider

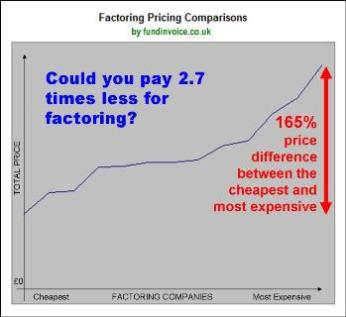

Because "debt factoring" is usually just invoice factoring by another name, the important question is not the label; it is whether the facility structure fits your business. Key areas to compare include service levels, eligibility rules, debtor limits, contract terms and pricing structure.

For help comparing options, see our Invoice Factoring page or use our independent quote search. If you prefer, call Sean on 03330 113622.