- 10 Nov

How Common Are Late Payments Among UK Businesses in 2025

Widespread late payments continue to affect UK businesses, and our latest survey highlights just how common the problem remains in 2025. This snapshot shows how often firms are paid late and what it means for cash flow.

How Common Are Late Payments Among UK Businesses in 2025

Our recent survey of business owners found that most firms experience invoices being paid after agreed terms, often by more than a week. While a few days may not seem severe, repeated delays can quickly build pressure on cash flow and create uncertainty around day-to-day operations.

This article sets out what we found, why late payments persist, and how companies can protect themselves. If late payers are affecting your cash flow or making it harder to plan, we can help you explore finance options to free up money tied up in unpaid invoices.

What The Survey Showed

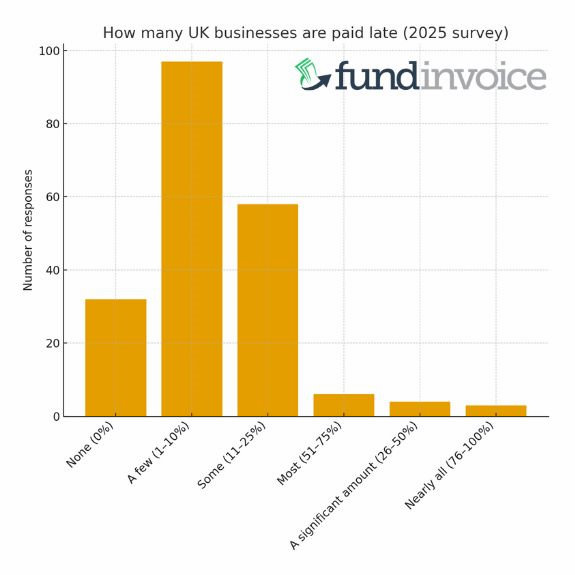

When we asked UK businesses what proportion of their sales were paid late, the responses were clear. Only a minority said they were paid on time. The rest experienced some level of delay.

The most common answers were:

-

A few late payments (1 to 10% of payments): 49% of respondents

-

Some late payments (11 to 25% of payments): 29% of respondents

-

None (0% of payments): 16% of respondents

-

Most late payments (51 to 75% of payments): 3% of respondents

-

A significant amount (26 to 50% of payments): 2% of respondents

-

Nearly all payments are late (76 to 100% of payments): 2% of respondents

(Note: total addition of percentages reflects rounding)

This shows that late payment is not an isolated issue. It affects organisations of all sizes. Many firms rely on predictable customer payments to cover suppliers, wages, and general running costs. When invoices slip, stress levels rise, and owners are forced to put time and energy into chasing payments rather than growing their business.

You can read more about the general challenges businesses face with payment delays in our Late Payment Help guide.

How Long Businesses Wait To Get Paid

Our data also showed that payment delays vary widely.

The largest group reported waiting between 1 and 7 days beyond the terms. Another sizable group said customers took 8 to 14 days longer. More concerning is that many companies face delays of a month or more, with a small number waiting over 60 days.

These long delays often cause the most disruption. A business might have planned to use that payment to settle supplier invoices or fund new work. When the money does not arrive, owners are forced to use reserves, personal funds, overdrafts or credit cards, all of which create additional costs or pressure.

If this sounds familiar, you may find our page on cash flow finance useful.

Why Late Payments Remain Widespread

Several factors may have contributed to delays reported in our research:

- Customers are managing their own cash flow by stretching terms.

- Administrative delays or slow approval processes.

- Businesses working with large organisations that use extended payment cycles.

- A lack of clear terms or follow-up on overdue invoices.

Even when a customer is reliable, internal processes can slow everything down. Many firms said they have strong customer relationships, but still wait weeks longer than expected to be paid.

The Effect On Business Cash Flow

Late payments directly affect working capital. Many survey respondents reported regular cash flow pressure caused by overdue invoices. Some had to delay payments to suppliers or slow planned investments. A small but important group said late payments had threatened their ability to operate normally.

If you rely heavily on a few key customers or work in a sector where long payment cycles are common, late payments can create real uncertainty. This is why many businesses look for ways to release cash from unpaid invoices rather than waiting for customers to settle.

Funding Options That Remove The Wait To Be Paid

One of the simplest ways to protect against late payments is to release the invoice value earlier.

Options include:

- Invoice finance - which advances most of the invoice value as soon as you raise it.

- Factoring - which includes support with chasing payments.

- Invoice discounting - which provides funding but doesn't include chasing support.

These options give you immediate access to the money you have already earned, helping you avoid the stress and disruption caused by slow payers.

Check Your Cash Flow Position For Free

If you want a quick way to understand how late payments may be affecting you, try our Cash Flow Health Check and Fix Kit. It offers a quick way to check your cash flow and practical steps to strengthen it and reduce the impact of overdue invoices.

Get Personalised Help

If late payments are becoming a problem or you are simply tired of waiting to get paid, we can help you compare finance options. Our service is free to use, and we work with providers across the market to find the right fit for your business.

Contact us on 03330 113622 to discuss your cash flow situation and explore options that can give you more control and peace of mind.

-

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Asset Finance And Mortgages

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog