- 07 Feb

Change From Factoring To Selective Factoring

Frequently within the factoring arena, it is never a case of "one size fits all". We had a case with an existing client, a small recruitment company that we had found a factoring facility with a leading whole turnover factoring company.

Frequently within the factoring arena, it is never a case of "one size fits all". We had a case with an existing client, a small recruitment company that we had found a factoring facility with a leading whole turnover factoring company.The issue for our client was that, as a new startup, they were finding their sales turnover sporadic, so the facility was not really ideal for them.

Whole Turnover Versus Selective

With a whole turnover arrangement the client submits all their sales to the finance company and they can also be subject to minimum levels of turnover each month, quarter or year. These minimums are often put in place to ensure that the client meets the projected sales turnover upon which the factor has based their costing. For example, if you were to project a turnover of say £3,000,000 per annum - you would be able to command very fine rates. As the service charge is usually a percentage of your turnover it means that if you only achieve £300,000, the factor would have charged completely different rates, that were in line with a business of that size. This is why minimum fees are sometimes used.

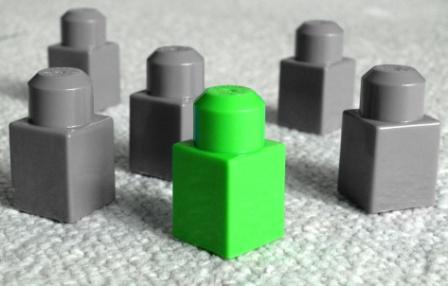

The alternative is selective factoring, also known as spot factoring - where you pick invoices to have funded without any minimum commitment.

Moving To Selective Factoring

In this particular case, the customer's turnover was not large enough to justify their current facility, so we were able to help them move to a selective factoring company. With this type of facility, they can choose which invoices to factor and they are not subject to any minimum charges. This can work well for a business that is in the startup phase or that has sporadic turnover. The cost is likely to be slightly higher, but you have the comfort of knowing that you are not going to have to pay any minimum charges if you don't achieve your projected level of turnover. It is important to weigh up the options, and these decisions can be critical in ensuring that your recruitment company thrives with the right type of funding behind it.

If you are in a similar position, you might find benefit from our help switching from whole-turnover to selective / spot beneficial.

Further Information

Article- More about funding recruitment agencies with invoice finance.

- Home

- Business Financing

- Invoice Finance

- Invoice Discounting

- Factoring

- Debt Factoring

- Recourse Factoring

- Fund Selected Invoices

- Business Loans

- Construction Sector Funding

- Protect Against Bad Debts

- Exports Collection And Funding

- Import Funding

- Body Shop Funding

- Spot Factoring

- Retail Sector Funding

- Fund Invoices Confidentially

- Help Running Your Payroll

- CHOCs Customer Handles Own Collections

- Collect Invoices Confidentially And Funding

- Outsourcing Your Credit Control

- Raise Money Against Other Assets

- Case Studies

- About Us

- Testimonials

- Find Out More

- News

- Free Magazine

- Blog